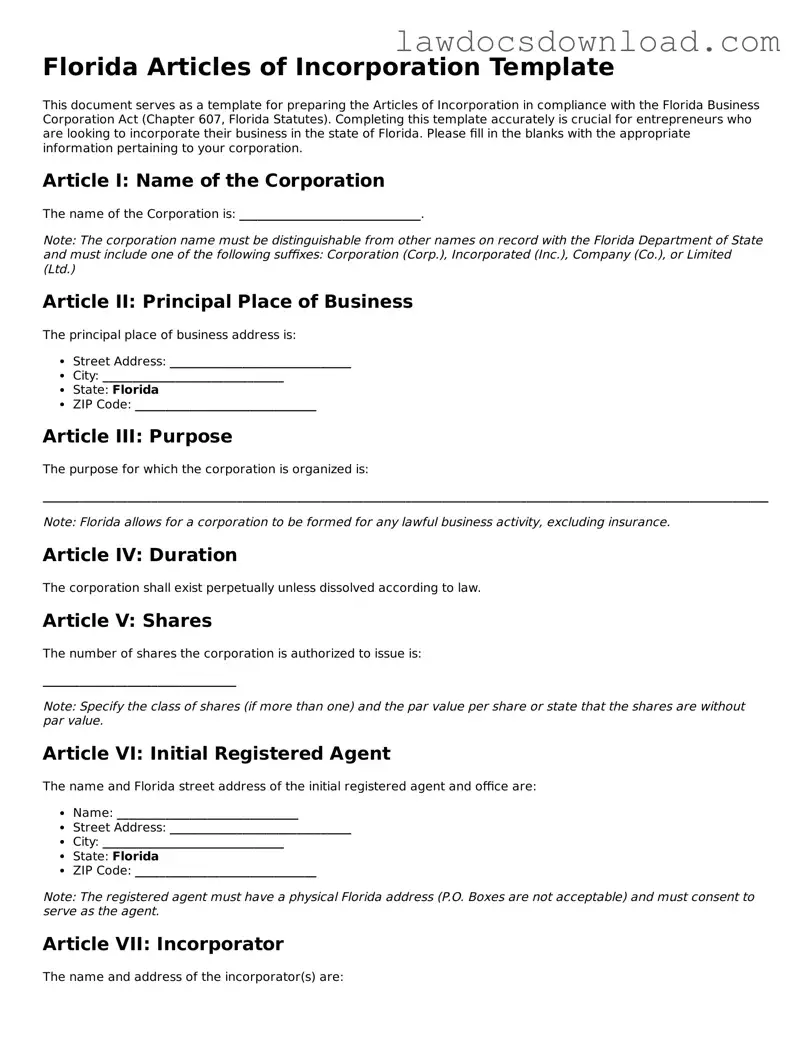

Florida Articles of Incorporation Template

This document serves as a template for preparing the Articles of Incorporation in compliance with the Florida Business Corporation Act (Chapter 607, Florida Statutes). Completing this template accurately is crucial for entrepreneurs who are looking to incorporate their business in the state of Florida. Please fill in the blanks with the appropriate information pertaining to your corporation.

Article I: Name of the Corporation

The name of the Corporation is: ______________________________.

Note: The corporation name must be distinguishable from other names on record with the Florida Department of State and must include one of the following suffixes: Corporation (Corp.), Incorporated (Inc.), Company (Co.), or Limited (Ltd.)

Article II: Principal Place of Business

The principal place of business address is:

- Street Address: ______________________________

- City: ______________________________

- State: Florida

- ZIP Code: ______________________________

Article III: Purpose

The purpose for which the corporation is organized is:

________________________________________________________________________________________________________________________

Note: Florida allows for a corporation to be formed for any lawful business activity, excluding insurance.

Article IV: Duration

The corporation shall exist perpetually unless dissolved according to law.

Article V: Shares

The number of shares the corporation is authorized to issue is:

________________________________

Note: Specify the class of shares (if more than one) and the par value per share or state that the shares are without par value.

Article VI: Initial Registered Agent

The name and Florida street address of the initial registered agent and office are:

- Name: ______________________________

- Street Address: ______________________________

- City: ______________________________

- State: Florida

- ZIP Code: ______________________________

Note: The registered agent must have a physical Florida address (P.O. Boxes are not acceptable) and must consent to serve as the agent.

Article VII: Incorporator

The name and address of the incorporator(s) are:

- Name: ______________________________

- Address: ______________________________

The incorporator is the person(s) who signs the Articles of Incorporation and is responsible for delivering them to the Department of State for filing.

Signatures

Upon completion, this document must be signed by the incorporator(s), acknowledging that the information provided is accurate and true. The signed original Articles of Incorporation should be filed with the Florida Department of State along with the required filing fee.

Incorporator's Signature: ________________________________

Date: ______________________