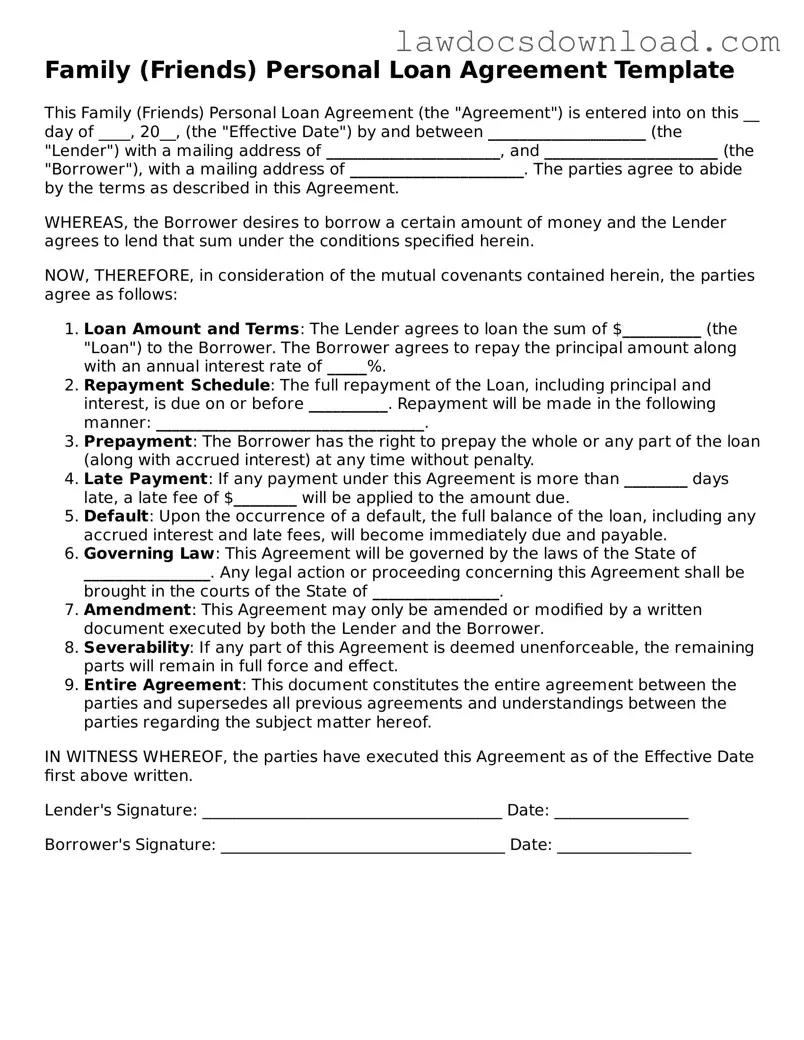

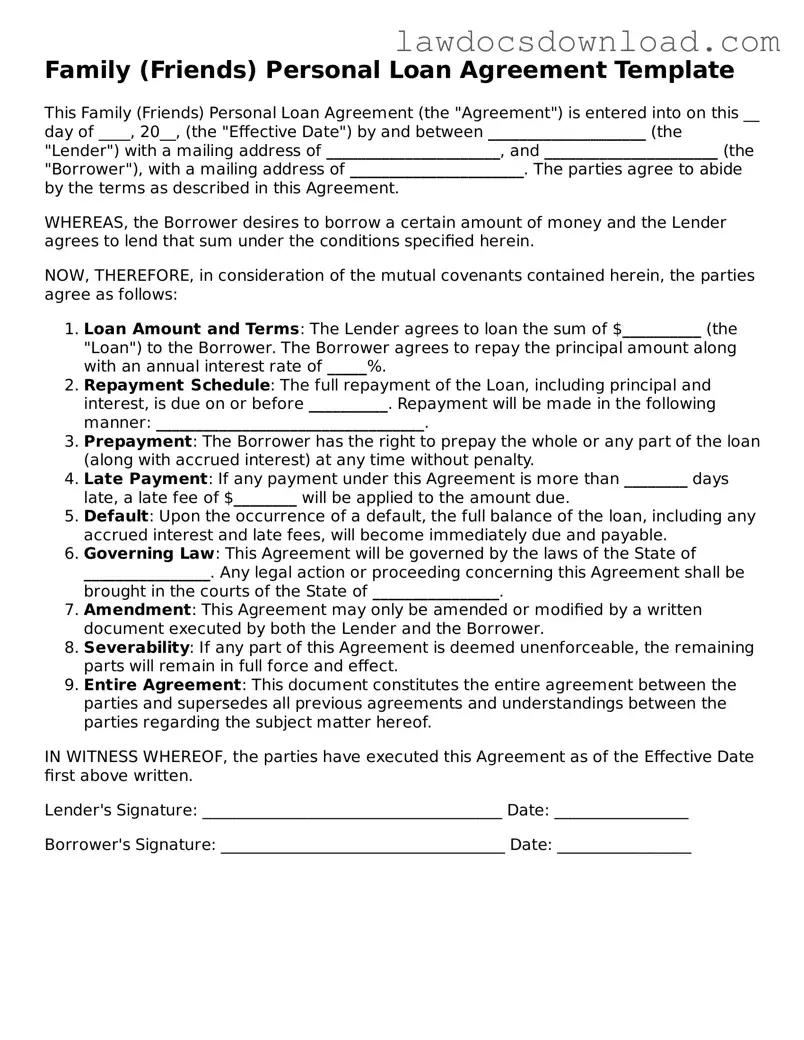

Blank Family (Friends) Personal Loan Agreement Template

A Family (Friends) Personal Loan Agreement form is a document that clearly stipulates the terms and conditions under which one party lends a specific amount of money to another. This form is crucial in maintaining transparency and trust between individuals who share a close relationship, whether they are family members or friends. It serves as a legally binding agreement, ensuring that both the lender and the borrower are aware of their obligations.

Launch Family (Friends) Personal Loan Agreement Editor Here

Blank Family (Friends) Personal Loan Agreement Template

Launch Family (Friends) Personal Loan Agreement Editor Here

Launch Family (Friends) Personal Loan Agreement Editor Here

or

Free Family (Friends) Personal Loan Agreement

Get this form done in minutes

Complete your Family (Friends) Personal Loan Agreement online and download the final PDF.