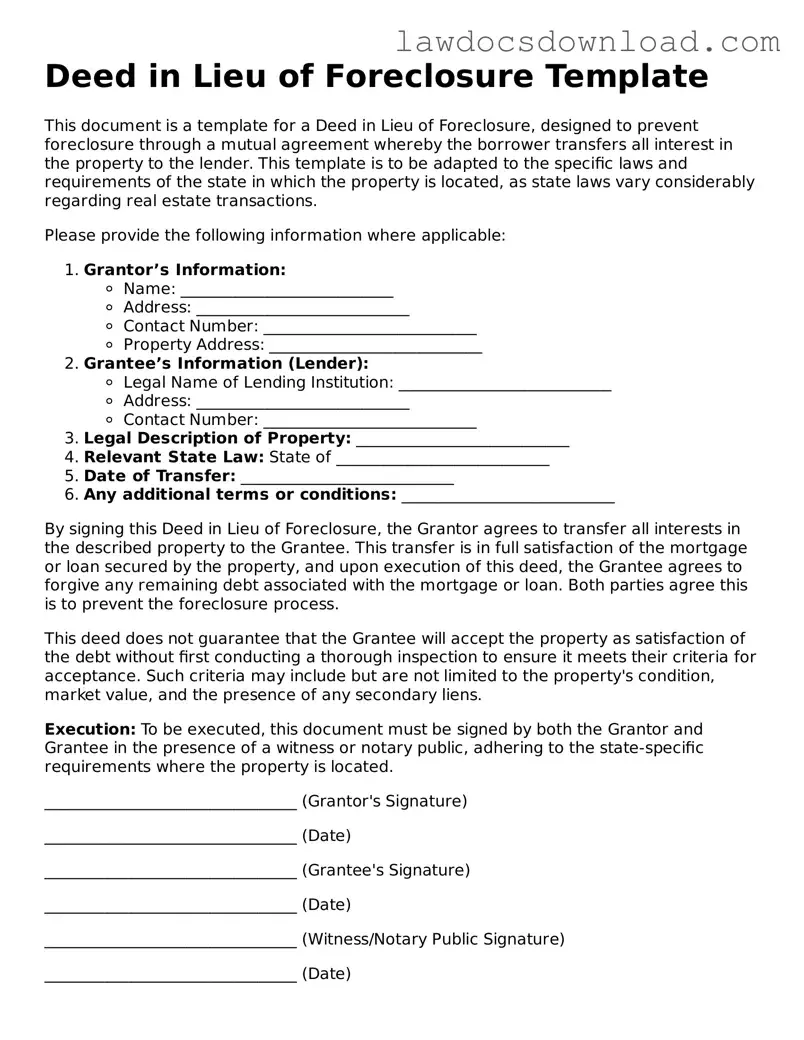

Blank Deed in Lieu of Foreclosure Template

A Deed in Lieu of Foreclosure form is an agreement where a homeowner voluntarily transfers ownership of their property to the lender to avoid the foreclosure process. This option can provide a way out for homeowners struggling to meet their mortgage obligations, allowing them to avoid the negative consequences of a foreclosure on their credit report. It's an important tool for individuals seeking a mutually beneficial solution with their lender.

Launch Deed in Lieu of Foreclosure Editor Here

Blank Deed in Lieu of Foreclosure Template

Launch Deed in Lieu of Foreclosure Editor Here

Launch Deed in Lieu of Foreclosure Editor Here

or

Free Deed in Lieu of Foreclosure

Get this form done in minutes

Complete your Deed in Lieu of Foreclosure online and download the final PDF.