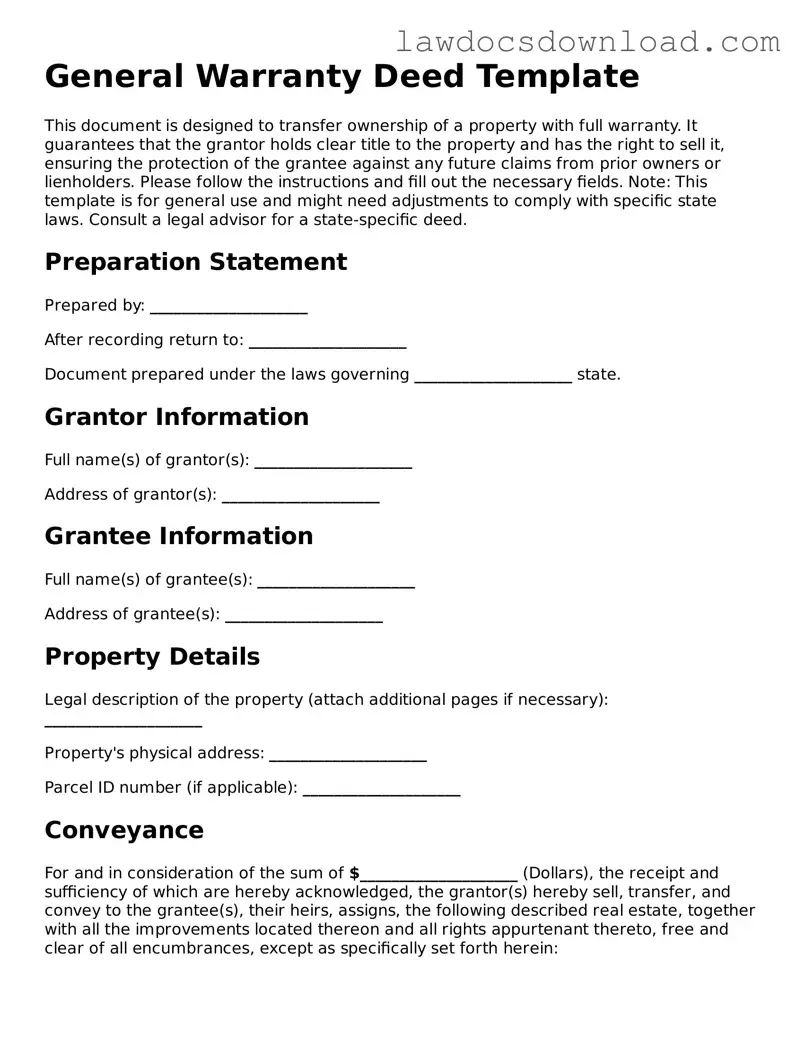

General Warranty Deed Template

This document is designed to transfer ownership of a property with full warranty. It guarantees that the grantor holds clear title to the property and has the right to sell it, ensuring the protection of the grantee against any future claims from prior owners or lienholders. Please follow the instructions and fill out the necessary fields. Note: This template is for general use and might need adjustments to comply with specific state laws. Consult a legal advisor for a state-specific deed.

Preparation Statement

Prepared by: ____________________

After recording return to: ____________________

Document prepared under the laws governing ____________________ state.

Grantor Information

Full name(s) of grantor(s): ____________________

Address of grantor(s): ____________________

Grantee Information

Full name(s) of grantee(s): ____________________

Address of grantee(s): ____________________

Property Details

Legal description of the property (attach additional pages if necessary): ____________________

Property's physical address: ____________________

Parcel ID number (if applicable): ____________________

Conveyance

For and in consideration of the sum of $____________________ (Dollars), the receipt and sufficiency of which are hereby acknowledged, the grantor(s) hereby sell, transfer, and convey to the grantee(s), their heirs, assigns, the following described real estate, together with all the improvements located thereon and all rights appurtenant thereto, free and clear of all encumbrances, except as specifically set forth herein:

Exceptions or Reservations

Specify any exceptions or reservations (if any): ____________________

Signatures

The parties have executed this deed on this ____ day of ____________________, 20____.

Grantor Signature(s): ______________________________________________________

Grantee Signature(s): ______________________________________________________

Acknowledgment

State of ____________________

County of ____________________

On this ____ day of ____________________, before me, a notary public, personally appeared the above-named grantor(s) and grantee(s), known or identified to me to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I have hereunto set my hand and official seal on the date above written.

Notary Public Signature: ______________________________________________________

My commission expires on: ____________________