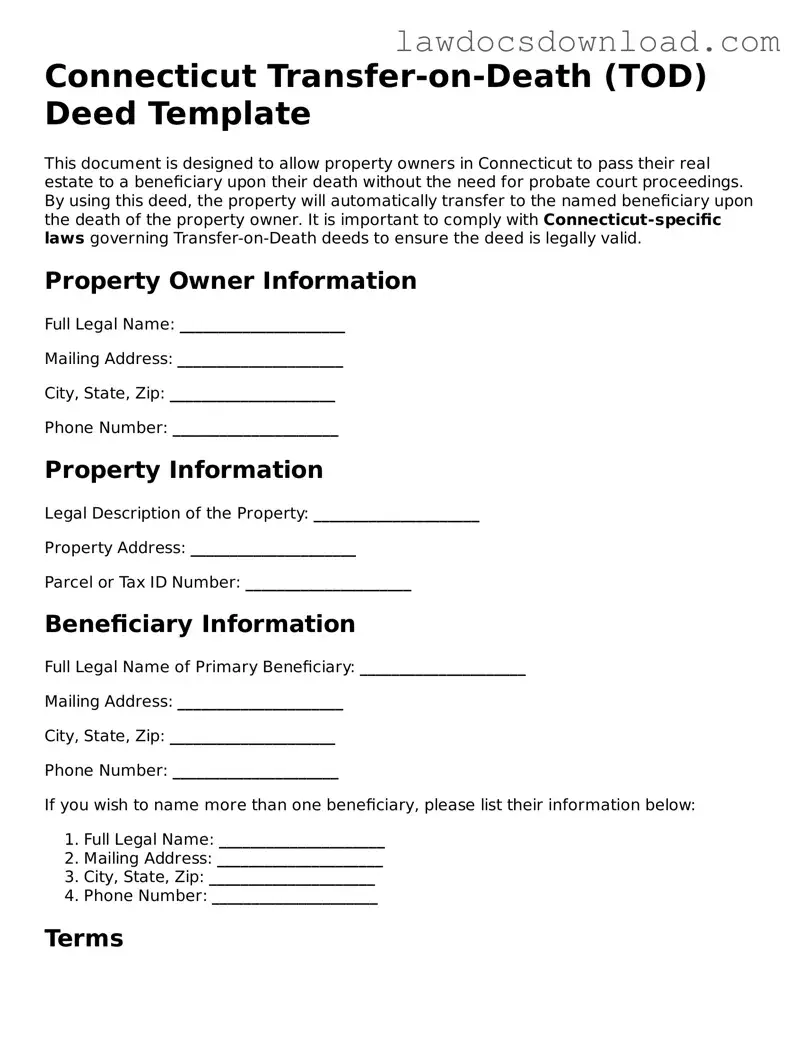

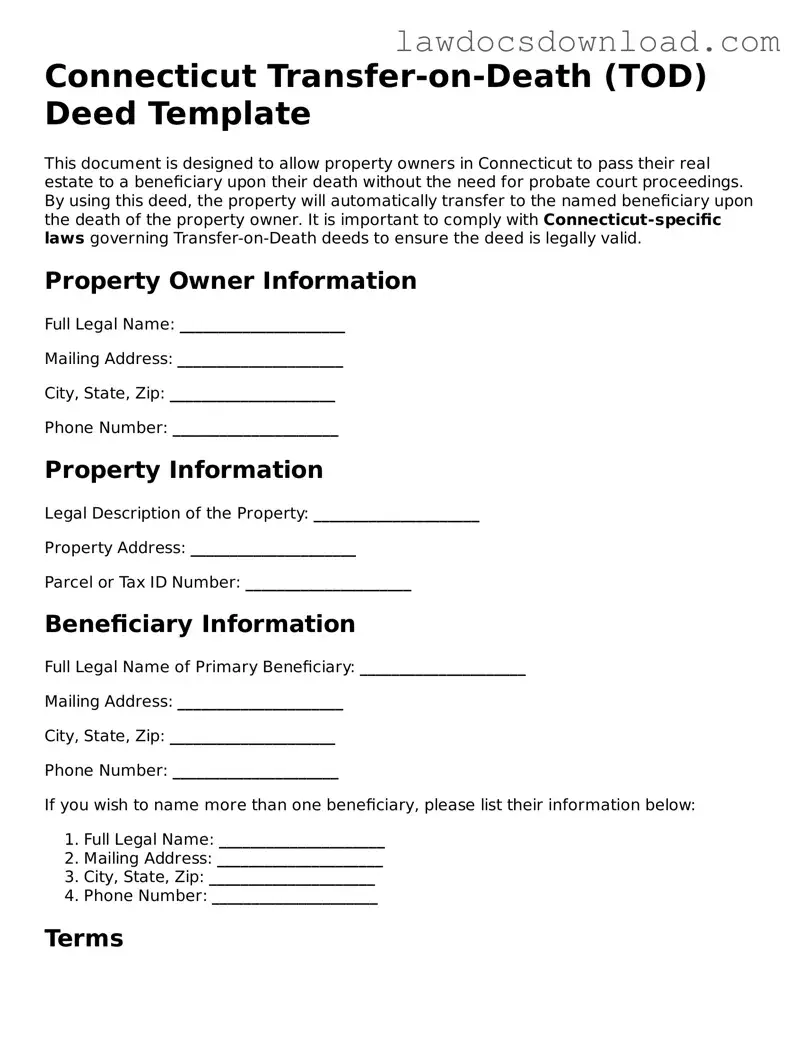

Legal Connecticut Transfer-on-Death Deed Form

The Connecticut Transfer-on-Death Deed form allows property owners to pass their real estate directly to a beneficiary upon their death, bypassing the often complex and costly probate process. This tool serves as a valuable part of estate planning, enabling a smoother transition of assets. However, careful consideration and precise execution are crucial, as the specifics of the form dictate how effectively it operates within these intentions.

Launch Transfer-on-Death Deed Editor Here

Legal Connecticut Transfer-on-Death Deed Form

Launch Transfer-on-Death Deed Editor Here

Launch Transfer-on-Death Deed Editor Here

or

Free Transfer-on-Death Deed

Get this form done in minutes

Complete your Transfer-on-Death Deed online and download the final PDF.