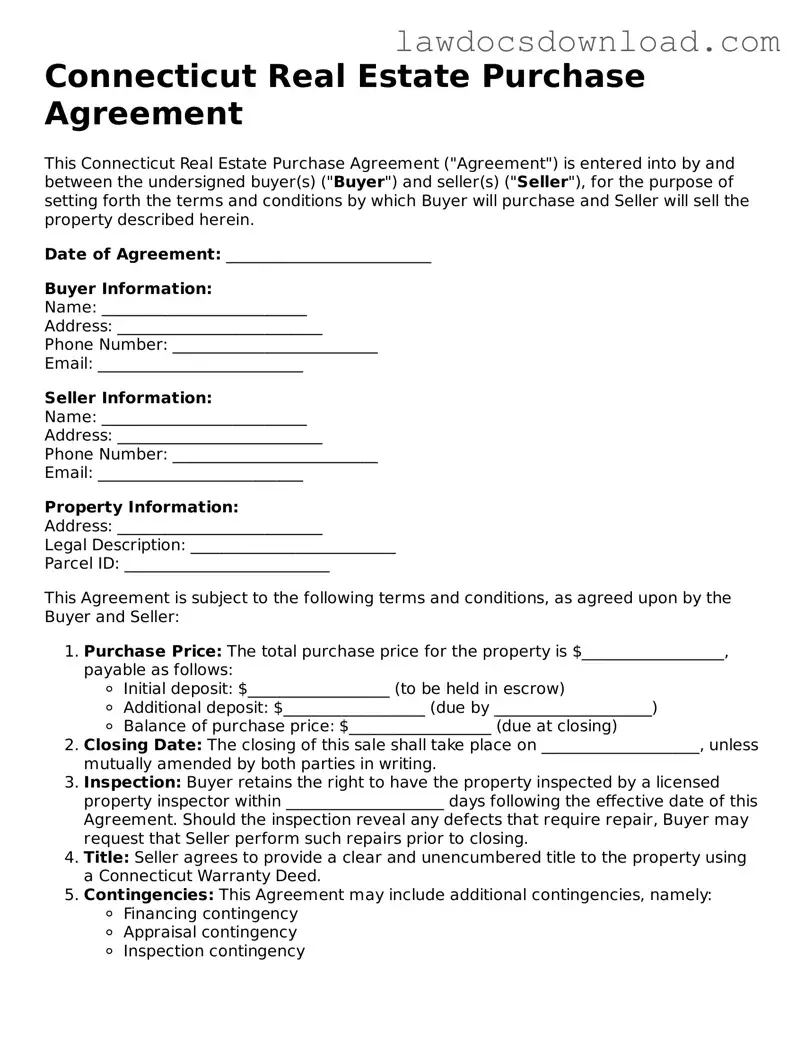

Legal Connecticut Real Estate Purchase Agreement Form

The Connecticut Real Estate Purchase Agreement form is a crucial document used in the process of buying or selling property in Connecticut. It outlines the terms and conditions agreed upon by both the buyer and the seller. This agreement serves as a legally binding contract that ensures all parties are clear on their responsibilities and the details of the property transaction.

Launch Real Estate Purchase Agreement Editor Here

Legal Connecticut Real Estate Purchase Agreement Form

Launch Real Estate Purchase Agreement Editor Here

Launch Real Estate Purchase Agreement Editor Here

or

Free Real Estate Purchase Agreement

Get this form done in minutes

Complete your Real Estate Purchase Agreement online and download the final PDF.