Legal Connecticut Promissory Note Form

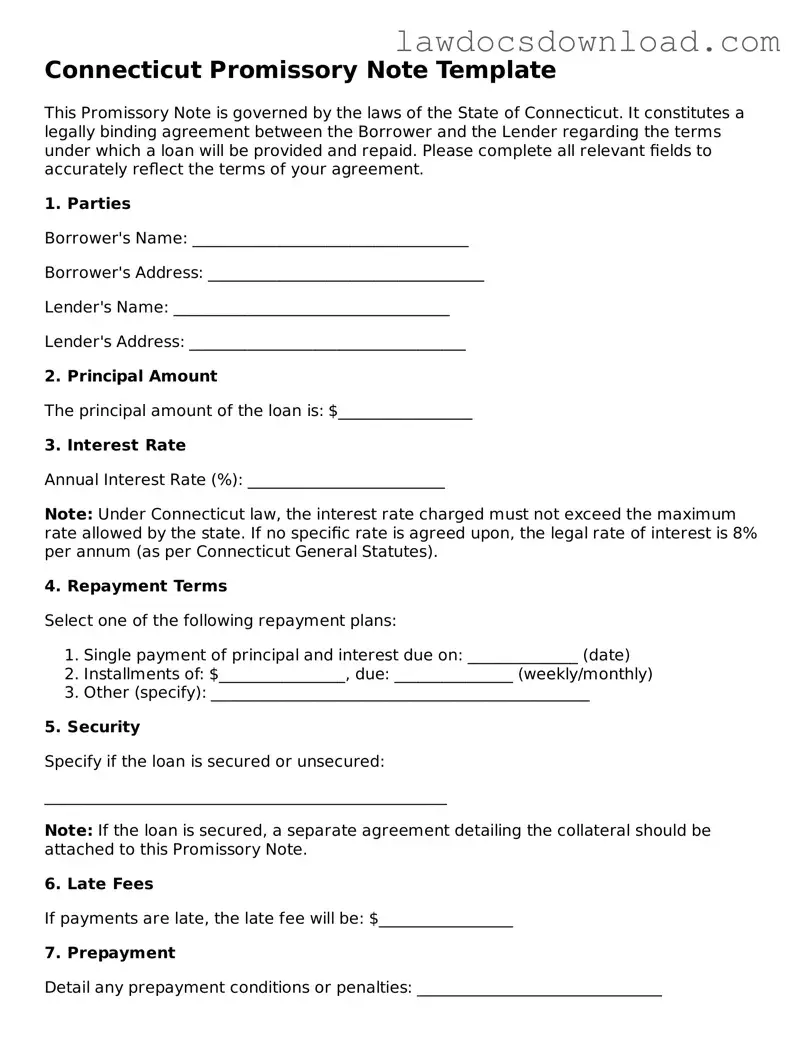

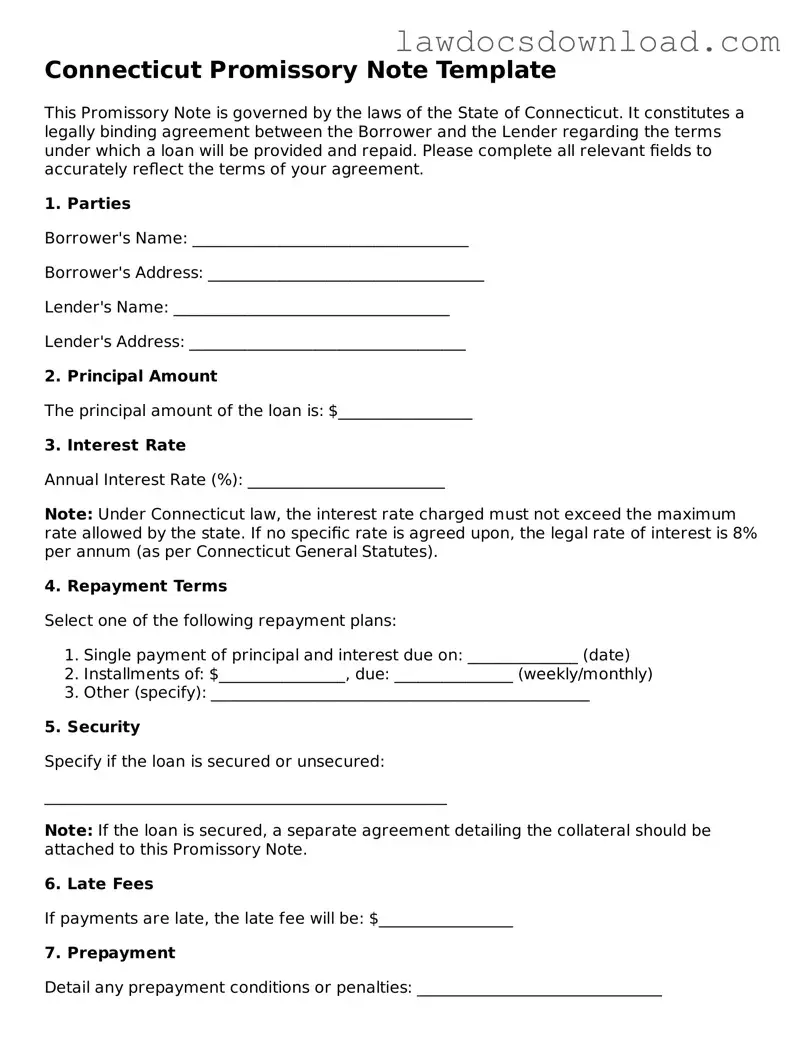

A Connecticut Promissory Note form is a legal document that outlines a promise to pay a specific sum of money from the borrower to the lender. It serves as a formal commitment, ensuring that the borrower agrees to repay the loan under agreed upon terms and conditions. This agreement is crucial for both parties, providing a clear, legal framework for the repayment process.

Launch Promissory Note Editor Here

Legal Connecticut Promissory Note Form

Launch Promissory Note Editor Here

Launch Promissory Note Editor Here

or

Free Promissory Note

Get this form done in minutes

Complete your Promissory Note online and download the final PDF.