Filling out legal documents can sometimes feel like navigating through a maze blindfolded, especially when it involves something as substantial as a mobile home transaction. The Connecticut Mobile Home Bill of Sale form is crucial in this process, and mistakes made here can lead to headaches down the road. Let’s walk through some common missteps to help you steer clear of future troubles.

First and foremost, a surprisingly common mistake is not checking to ensure the form is the current version issued by Connecticut. Laws and regulations change, and ensuring you have the most up-to-date document is pivotal. Using an outdated form can invalidate the transaction.

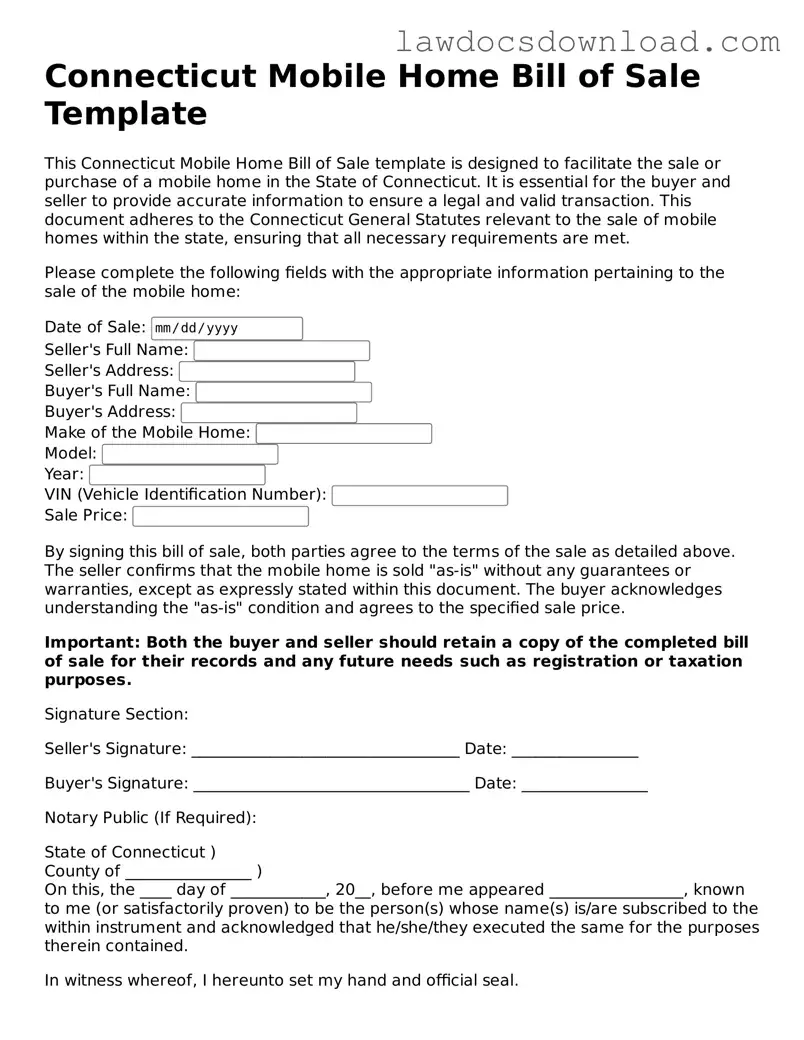

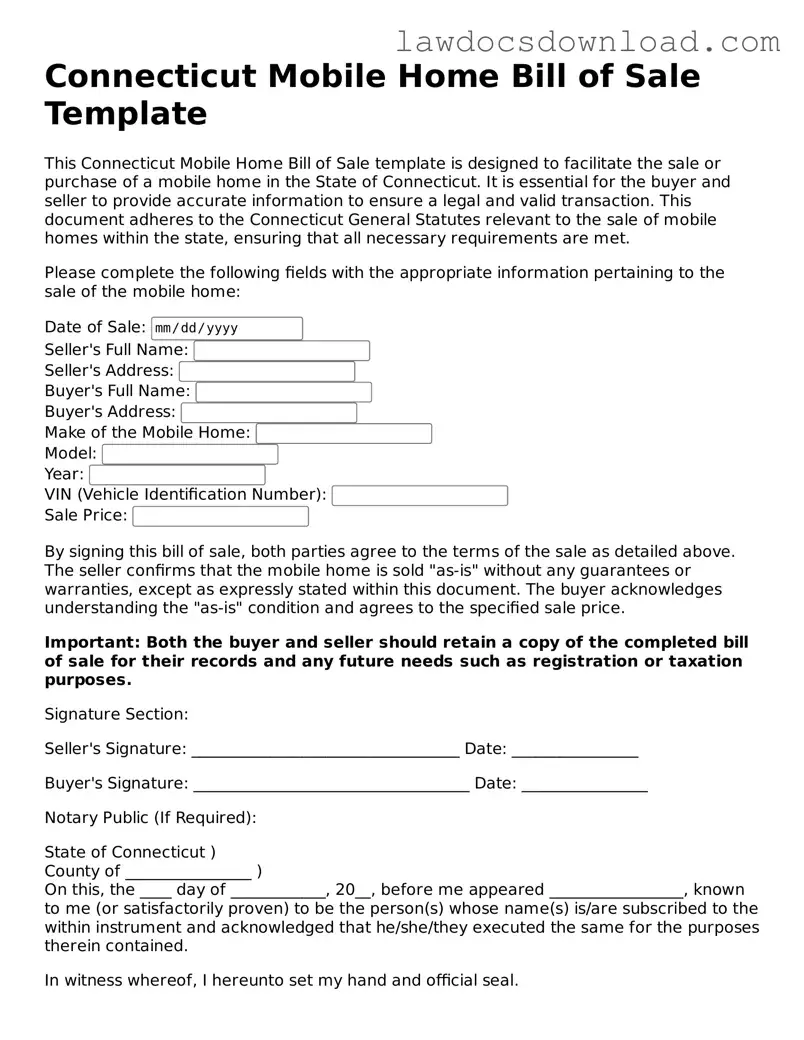

Many folks overlook the importance of including all necessary details about the mobile home. This includes the make, model, year, and serial number. It’s not enough to just describe the home as "the blue one on lot 5." Precision here is essential for legal protection and clarity in ownership records.

Another pitfall is mistreating the form as a one-size-fits-all solution. The Connecticut Mobile Home Bill of Sale form requires specific information related to the transaction taking place in Connecticut. Ignoring state-specific requirements can render the document less effective or even void. For instance, failing to acknowledge or adhere to the state’s guidelines on sales tax or ownership transfer could lead to unnecessary legal complications.

Incorrect or incomplete buyer and seller information is a frequent mistake. Names should match official IDs or documents, and contact information should be current. A typographical error in an address or name might seem minor, but it can significantly delay or disrupt the transaction process.

A rather critical error is not specifying the sale conditions. Whether the sale includes furnishings, annexes, or is subject to certain restrictions or conditions, it must be clearly outlined. Vague terms can lead to disputes post-transaction.

Forgetting to include the sale date and the transaction amount is more common than you’d think. These details provide a timeline and financial clarity, vital for both tax purposes and legal verification of the transfer's integrity.

Neglecting to detail the terms of payment can also lead to confusion or disagreements later on. Whether the payment is in cash, through a payment plan, or via another arrangement, it’s important to lay it out clearly in the document.

Failing to secure signatures and date them is akin to forgetting to put a stamp on an envelope. Without the signatures of both parties and a witness (if required), the document lacks the necessary legal standing. Moreover, undated signatures can raise questions regarding the transaction’s timing and validity.

Not having the document notarized, while not always legally required, is often advisable, especially for high-value transactions like mobile homes. Notarization adds a layer of verification and authenticity to the document, providing additional protection for all parties involved.

Last but certainly not least, making the mistake of not keeping a copy of the bill of sale can lead to problems in the future. Both buyer and seller should keep a copy for their records. It’s your proof of transaction, necessary for addressing any future disputes, for tax purposes, or when seeking financing.

By avoiding these common mistakes, parties involved in a mobile home sale in Connecticut can ensure a smoother transaction. Remember, it’s not just about filling out a form, but about protecting your investment and rights through the proper legal channels.