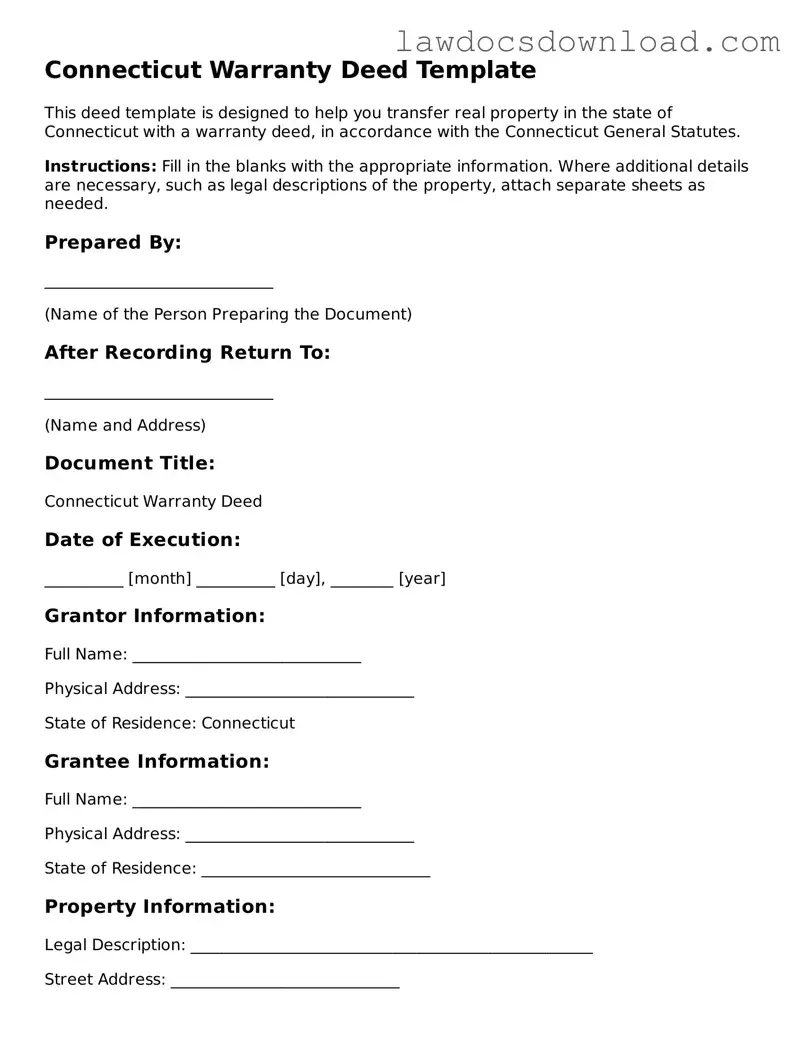

Connecticut Warranty Deed Template

This deed template is designed to help you transfer real property in the state of Connecticut with a warranty deed, in accordance with the Connecticut General Statutes.

Instructions: Fill in the blanks with the appropriate information. Where additional details are necessary, such as legal descriptions of the property, attach separate sheets as needed.

Prepared By:

_____________________________

(Name of the Person Preparing the Document)

After Recording Return To:

_____________________________

(Name and Address)

Document Title:

Connecticut Warranty Deed

Date of Execution:

__________ [month] __________ [day], ________ [year]

Grantor Information:

Full Name: _____________________________

Physical Address: _____________________________

State of Residence: Connecticut

Grantee Information:

Full Name: _____________________________

Physical Address: _____________________________

State of Residence: _____________________________

Property Information:

Legal Description: ___________________________________________________

Street Address: _____________________________

County: _____________________________

State: Connecticut

Conveyance:

The Grantor(s) conveys and warrants to the Grantee(s) the above-described real property, together with all the improvements, rights, and appurtenances therein, free and clear of all encumbrances, except as specifically noted herein:

___________________________________________________

Consideration:

The total consideration for this conveyance is $_________________.

Signatures:

Witnessed by:

_____________________________ _____________________________

(Signature of Witness) (Print Name of Witness)

State of Connecticut, County of ____________________:

This document was acknowledged before me on ________ [month] ________ [day], ________ [year], by _____________________________, the Grantor.

_____________________________

(Signature of Notary Public)

My commission expires: ________

Grantor Signature(s):

_____________________________ _____________________________

(Signature of Grantor) (Print Name of Grantor)

Legal Notice:

This template provides a basic outline for a Connecticut Warranty Deed, but legal documents can carry significant legal consequences. It is recommended that you consult with a real estate attorney or legal advisor to ensure the accuracy and legality of your deed before filing it with the appropriate county recorder's office.