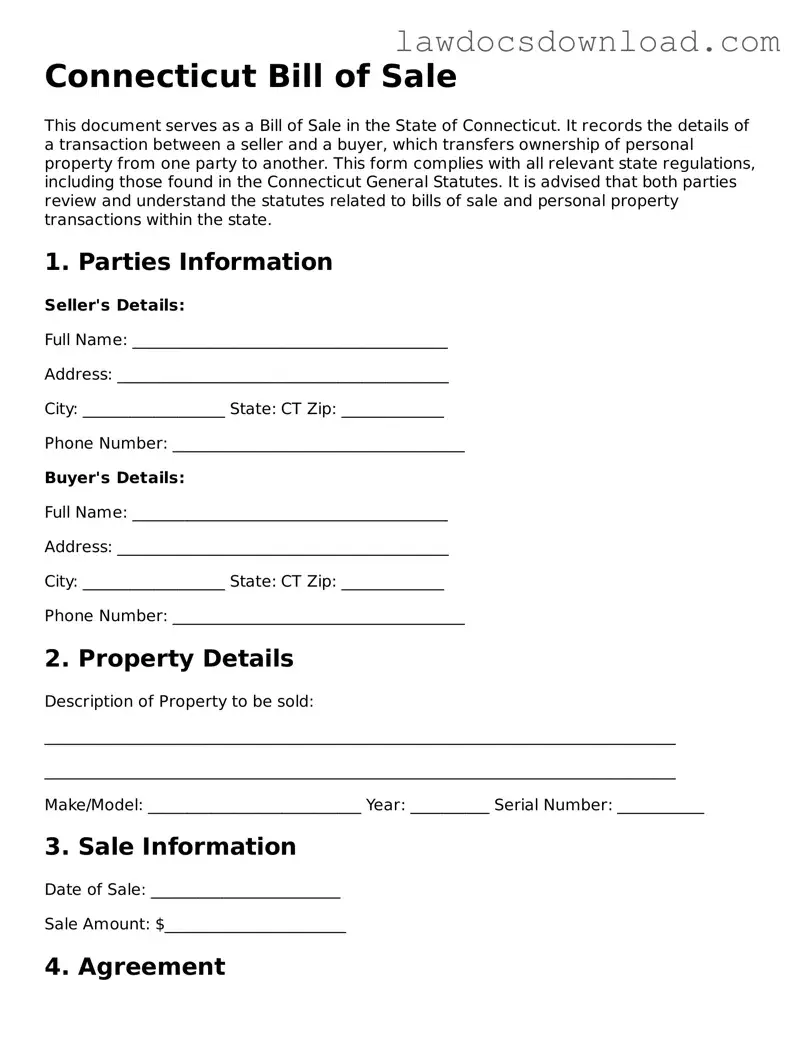

Connecticut Bill of Sale

This document serves as a Bill of Sale in the State of Connecticut. It records the details of a transaction between a seller and a buyer, which transfers ownership of personal property from one party to another. This form complies with all relevant state regulations, including those found in the Connecticut General Statutes. It is advised that both parties review and understand the statutes related to bills of sale and personal property transactions within the state.

1. Parties Information

Seller's Details:

Full Name: ________________________________________

Address: __________________________________________

City: __________________ State: CT Zip: _____________

Phone Number: _____________________________________

Buyer's Details:

Full Name: ________________________________________

Address: __________________________________________

City: __________________ State: CT Zip: _____________

Phone Number: _____________________________________

2. Property Details

Description of Property to be sold:

________________________________________________________________________________

________________________________________________________________________________

Make/Model: ___________________________ Year: __________ Serial Number: ___________

3. Sale Information

Date of Sale: ________________________

Sale Amount: $_______________________

4. Agreement

The undersigned seller affirms that the information provided about the above-described property is true to the best of their knowledge, that the property is being sold "as is", and that they have the lawful right to sell this property. The buyer accepts the property "as is", assuming all responsibilities related to the property upon purchase. This document does not certify or validate that the seller has legal ownership of the property described; it only records the transaction between the buyer and seller.

5. Signatures

This document is not legally binding without the signatures of both the seller and the buyer. By signing, both parties agree to the terms as described above.

Seller's Signature: ___________________________ Date: _______________

Buyer's Signature: ___________________________ Date: _______________

This template provides a basic structure for a Bill of Sale in Connecticut. However, it’s important for both parties to consult with a legal professional to ensure that this document meets all legal requirements for the specific type of property being sold and the particulars of the transaction.