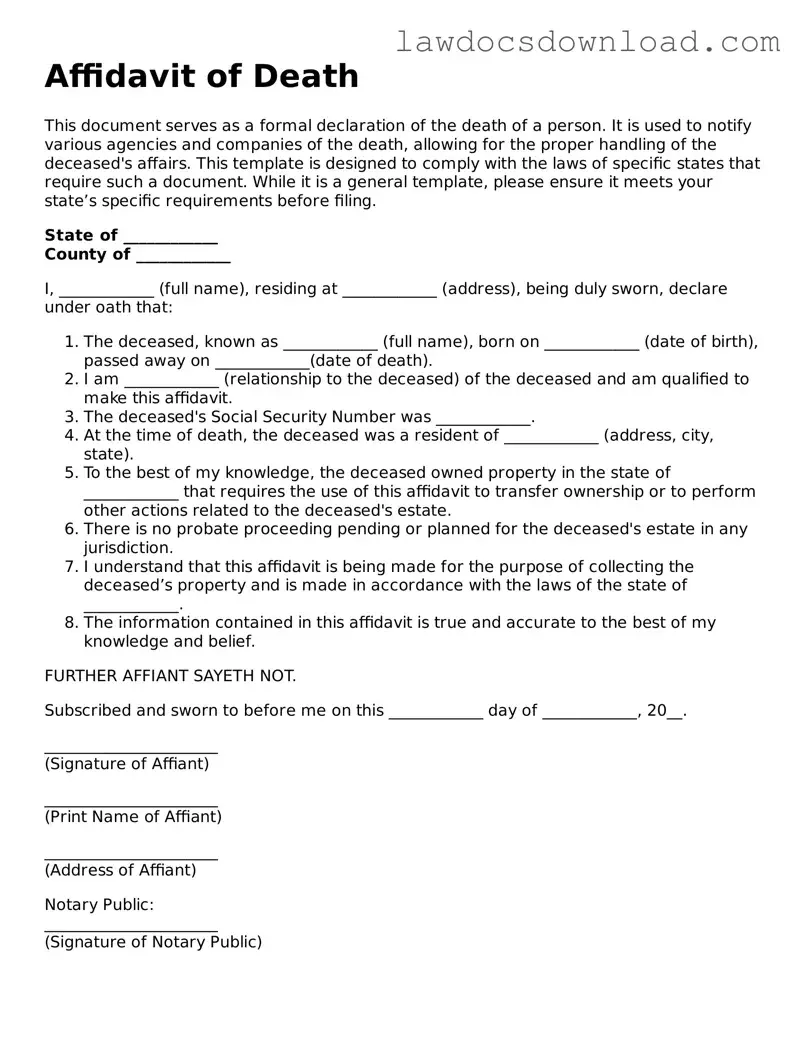

Filling out an Affidavit of Death is a necessary step in many legal processes following the death of an individual. This document officially states the death of a person, assisting in the execution of their will, the transfer of property, and other important transactions. However, throughout this delicate process, several common mistakes can occur, often due to the emotionally charged context in which these forms are filled out.

One frequent mistake is the incorrect identification of the decedent. It's crucial to use the full legal name as it appears on official documents such as the birth certificate, passport, or driver's license. This might seem straightforward, but errors can easily slip through, especially with names that include junior (Jr.), senior (Sr.), middle names, or initials.

Another common error is not providing the correct date of death. This date must correspond exactly with the date on the death certificate. Any discrepancies here can cause delays or question the veracity of the document, complicating otherwise straightforward legal processes.

People often overlook the necessity of attaching a certified copy of the death certificate to the affidavit. While the affidavit attests to the death, the certified death certificate provides the official and legal confirmation. Failing to attach this document can invalidate the affidavit or significantly delay its processing.

A further mistake lies in the incorrect description of the property or assets linked with the decedent. If the affidavit is part of transferring ownership, it must accurately describe these items, including any identifying numbers or legal descriptions for real estate. Errors or vagueness in this section can hinder the transfer process or cause legal disputes among heirs or beneficiaries.

Some individuals mistakenly believe they can use a single affidavit to address all aspects of an estate. However, depending on the complexity and location of the assets, separate affidavits might be necessary for different properties or accounts, each tailored to meet specific legal requirements.

Not having the affidavit notarized is another common error. A notarized affidavit confirms the identity of the person signing the document, adding a level of legal authentication. Skipping this step can render the document unofficial in the eyes of the law.

People sometimes forget to file the completed affidavit with the appropriate government office or financial institution. Holding onto the document without properly submitting it can lead to unnecessary delays in estate resolution and property transfer.

Lastly, there can be a failure to follow up with entities after submitting the affidavit. Simply assuming that the document has been processed and that assets have been transferred can lead to unaddressed issues. It's important to confirm that the necessary changes have been made and that all assets are properly accounted for and transferred according to the decedent's wishes.

By being mindful of these common mistakes and taking steps to avoid them, individuals can ensure a smoother process in managing the affairs of a deceased loved one, which is a crucial part of honoring their memory and respecting their final wishes.